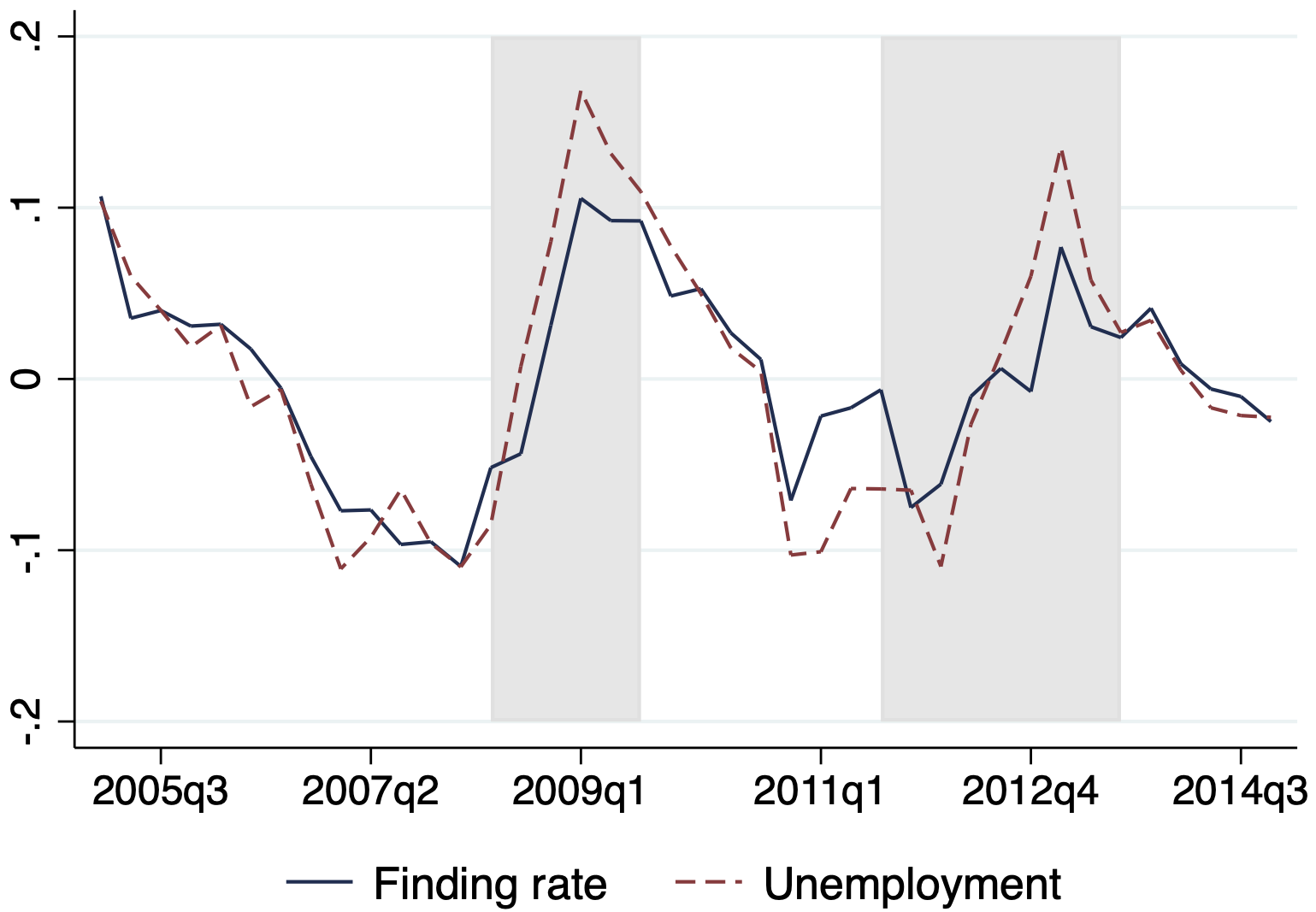

In this paper, we analyze the cyclicality of the Italian unemployment rate over the period 2005 to 2014, examining how the job finding and separation rates contribute to aggregate unemployment volatility. Using our baseline model, which considers a two-state economy (employment and unemployment), we find that the job finding rate explains on average approximately 60% of unemployment fluctuations, with the job separation rate’s influence that has grown over time. This result suggests that during downturns, the unemployment rate increases largely due to prolonged jobless spells rather than higher separation rates. These results align with the evidence from other developed economies, where the job finding rate tends to dominate (Elsby et al., 2013).

Building on this evidence, we expand the analysis in several directions. Specifically, we move beyond the baseline analysis and develop a labor market model that incorporates individual-specific heterogeneity and differentiates between open-ended and fixed-term contracts, a contract duality that characterizes most of the European labor markets. This interaction between worker characteristics and contract types – offering varying degrees of employment stability – provides a comprehensive understanding of labor market dynamics over the business cycle.

In terms of individual heterogeneity, we consider both observable demographic characteristics in the data and latent individual-specific components. Specifically, based on both labor market histories and income realizations, we assign each worker to a continuum of latent types. The model assumes a positive relationship between latent types and income levels, whereas the influence of latent types on labor market trajectories is estimated without restrictions, allowing the model to empirically capture how worker careers diverge based on latent productivity (Lagrosa, 2024). This combined approach provides a measure of latent heterogeneity that captures pure individual-specific effects on income (productivity or ability), independent of the performance in the labor market – such as time spent in non-employment over the career.

First, this framework enables us to analyze the relative contribution of job finding and separation rates to unemployment fluctuations across varying groups of individuals, examining how the two transition rates differently shape unemployment dynamics within heterogeneous segments of the population. In terms of observable demographic characteristics, we find that for young workers the job finding rate plays a crucial role. It accounts for 67% of unemployment fluctuations in the 16-24 age group, with the contribution dropping to 31% among those aged 55-64. This reflects young workers’ longer jobless spells in recessions. Gender and geographic disparities show a less pronounced but notable pattern: the job finding rate contributes slightly more to female unemployment volatility (73%) than to male (63%) and is less influential in the North (64-69%) compared to the South (69%).

Second, we assess how different groups of workers contribute to aggregate unemployment cyclicality over the business cycle. We hypothesize that unemployment fluctuations are primarily driven by specific groups, such as young and less productive individuals, while other workers contribute less to these cyclical changes.

Preliminary findings on contract duality reveal that although fixed-term jobs do not significantly drive overall unemployment dynamics, their impact is more pronounced for specific groups of workers, particularly young individuals and those in Northern Italy.

Our work is closely connected to prior research examining the contributions of inflows and outflows to unemployment cyclicality. A substantial body of literature investigates this question, particularly for the United States (e.g., Shimer, 2007; Fujita and Ramey, 2009; Elsby et al., 2009; Shimer, 2012). Following the 2008 financial crisis, attention expanded to European countries: Hairault et al. (2015) analyzed France; Smith (2011) and Gomes (2012) focused on the UK; Silva and Vazquez-Grenno (2013) investigated Spain and the UK; while Petrongolo and Pissarides (2008) and Elsby et al. (2013) examined multiple OECD countries. We extend this literature by analyzing unemployment dynamics in Italy – a labor market not yet extensively studied – and by jointly incorporating individual heterogeneity and contractual duality.

Our paper also contributes to recent studies that estimate workers’ latent types based on observed labor market transitions, a line of research primarily focused on the U.S. economy. Hall and Kudlyak (2019) develop a model classifying workers into five types according to their labor market trajectories. Similarly, Gregory et al. (2021) identify three latent worker types to capture heterogeneity in employment stability. More recently, Ahn et al. (2023) group individuals into three latent states using labor market histories, identifying a dual labor market structure alongside a segment linked to home production. Ahn and Hamilton (2020) specifically examine the role of unobserved heterogeneity in U.S. unemployment cyclicality by allowing sample composition to shift over the business cycle. Using cross-sectional unemployment rates by duration, they identify two latent worker types with different exit probabilities from unemployment. They find that shifts in the unemployment pool’s composition significantly impact economic downturns. Our study adds to this literature by focusing on a different national context and employing a novel estimation approach to measure latent heterogeneity, which draws on individual microdata and career-long observations at the worker level.